Volume in Trading: Understanding its Importance and How to Use it for Better Decisions

Volume in trading is a key aspect of trading that many traders often overlook or ignore. In simple terms, volume refers to the number of shares or contracts traded in a given time period. It is a measure of the market activity and an important indicator of a stock’s liquidity. Understanding volume is crucial for traders as it can provide valuable insights into the market, helping them make informed decisions.

The Importance of Volume in Trading

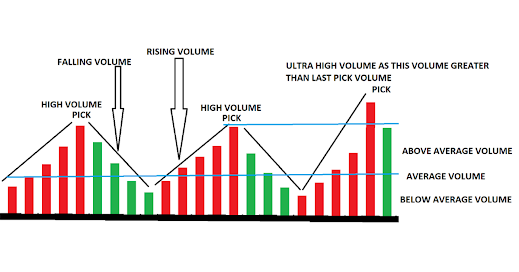

Volume is important in trading because it reflects the level of buying and selling activity in a stock. When volume is high, it means that many traders are buying and selling the stock, which can indicate strong market interest. This can be an important factor when making investment decisions. For example, if a stock is experiencing high volume, it may indicate a trend reversal or a breakout from a consolidation pattern.

Moreover, volume can also provide insights into the strength of a trend. A trend with high volume is considered to be stronger and more reliable than a trend with low volume. This is because high volume suggests that many traders agree with the trend and are taking action to participate in it.

Using Volume to Make Better Trading Decisions

Volume is a powerful tool for traders, but it is important to use it correctly. Here are some tips for using volume to make better trading decisions:

1. Look for Confirmation of Price Action: Volume can be used to confirm price action. If a stock experiences a sharp price increase, high volume can indicate that the trend is genuine and not just a temporary blip. On the other hand, if price action is not supported by high volume, it may indicate a false move.

2. Monitor Volume Changes: Changes in volume can also provide important information. For example, if volume spikes suddenly, it may indicate a trend reversal or a breakout. In such cases, traders can look to enter or exit positions.

3. Use Volume Indicators: There are several volume indicators that traders can use to gain a better understanding of volume. One popular indicator is the On-Balance Volume (OBV) which measures buying and selling pressure by accumulating volume on up days and subtracting it on down days.

4. Consider Volume in Relation to Other Indicators: It's important to consider volume in relation to other technical indicators. For example, if a stock is experiencing high volume and breaking out of a resistance level, it can be a strong bullish signal. On the other hand, if volume is declining while prices are rising, it may indicate a lack of conviction in the current trend.

5. Pay Attention to Volume During Earnings Releases: Volume can be particularly important during earnings releases. If a company releases positive earnings, high volume can indicate strong buying pressure as traders rush to buy the stock. On the other hand, if earnings are negative, high volume can indicate strong selling pressure as traders look to sell their positions.

6. Look for Volume Clusters: Volume clusters refer to areas on a chart where there is a concentration of volume. These clusters can indicate areas of support or resistance, and traders can use them to make decisions about entering or exiting positions.

7. Consider the Overall Market Context: It's also important to consider the overall market context when interpreting volume. For example, if the market as a whole is experiencing low volume, it may indicate a lack of market conviction, even if a particular stock is experiencing high volume.

Conclusion

In conclusion, volume is a critical aspect of trading that should not be ignored. It provides valuable insights into market activity, the strength of a trend, and buying and selling pressure. By using volume correctly, traders can make more informed decisions and improve their overall trading performance. Volume is an essential aspect of trading that provides valuable insights into market activity, the strength of a trend, and buying and selling pressure. By using volume in conjunction with other technical indicators and considering the overall market context, traders can make more informed decisions and improve their overall trading performance.

No comments:

Post a Comment