Mastering the MACD Crossover: An Essential Guide for Traders

Technical analysis is a cornerstone of successful trading, providing critical insights into market trends and helping traders make informed decisions. Among the various tools available, the MACD (Moving Average Convergence Divergence) crossover stands out as one of the most reliable and widely used indicators. Understanding how to effectively utilize the MACD crossover can significantly enhance your trading strategy and performance.

What is the MACD Indicator?

The MACD is a momentum and trend-following indicator that reveals the relationship between two moving averages of a security’s price. It comprises three main components:

- MACD Line: This is the difference between the 12-day Exponential Moving Average (EMA) and the 26-day EMA.

- Signal Line: This is the 9-day EMA of the MACD line.

- Histogram: This is the graphical representation of the difference between the MACD line and the Signal line, fluctuating above and below a zero line.

What is a MACD Crossover?

A MACD crossover occurs when the MACD line crosses the Signal line. This event can signal potential changes in market trends and momentum, providing traders with crucial buy and sell signals. There are two primary types of crossovers:

Bullish Crossover: When the MACD line crosses above the Signal line, it indicates that the security’s price might be gaining upward momentum, suggesting a potential buying opportunity.

Bearish Crossover: When the MACD line crosses below the Signal line, it indicates that the security’s price might be losing upward momentum or starting to decline, suggesting a potential selling opportunity.

|

| MACD CROSSOVER |

How to Use the MACD Crossover in Trading

To leverage the MACD crossover effectively, follow these steps:

1. Identify the Crossover

Monitor the MACD line and Signal line on your chart. Look for points where the MACD line crosses the Signal line.

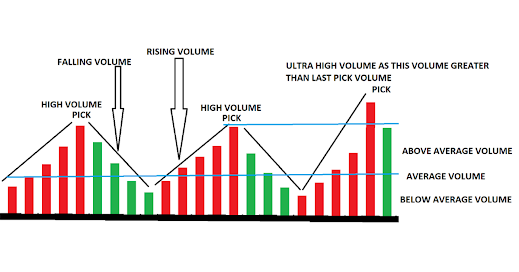

2. Confirm the Signal

Before acting on a crossover signal, confirm it with other technical indicators or analysis methods. This might include examining support and resistance levels, the Relative Strength Index (RSI), or trading volume.

3. Set Entry and Exit Points

For a bullish crossover, consider entering a long position (buying). For a bearish crossover, consider entering a short position (selling). Establish clear entry and exit points based on your trading strategy and risk tolerance.

4. Implement Risk Management

Always employ risk management techniques, such as stop-loss orders, to protect your investments. Remember, the MACD crossover is not infallible and can produce false signals.

5. Monitor Your Trades

Once you enter a trade based on a MACD crossover, continuously monitor your position and the indicator. Be prepared to adjust your strategy if market conditions change.

Advantages of Using the MACD Crossover

- Simplicity: The MACD crossover is straightforward to understand and implement, making it accessible for both novice and experienced traders.

- Effectiveness: It provides clear buy and sell signals, helping traders identify potential entry and exit points.

- Versatility: The MACD can be used across different time frames and types of securities, including stocks, forex, and commodities.

Limitations of the MACD Crossover

- Lagging Indicator: The MACD is based on moving averages, which are lagging indicators. This can sometimes result in delayed signals, particularly in rapidly changing markets.

- False Signals: The MACD crossover can produce false signals, especially in volatile or sideways markets. It's important to use it in conjunction with other indicators and analysis tools.

Practical Example of a MACD Crossover Trade

Let’s consider an example to illustrate how to use the MACD crossover:

- Identify the Crossover: You notice the MACD line crossing above the Signal line on a daily chart of a stock.

- Confirm the Signal: You check other indicators like the RSI, which shows the stock is not overbought, and the trading volume, which has increased.

- Set Entry Point: You decide to enter a long position at the current market price.

- Set Stop-Loss: To manage risk, you set a stop-loss order below the recent low.

- Monitor: You monitor the trade, looking for signs that the upward momentum is continuing.

Conclusion

The MACD crossover is a powerful tool for traders, offering valuable insights into market momentum and trend direction. By understanding and effectively utilizing MACD crossovers, traders can enhance their ability to make informed decisions and improve their overall trading performance. However, it’s crucial to remember that no single indicator should be used in isolation. Combining MACD crossovers with other forms of analysis and maintaining a robust risk management strategy is key to successful trading.

Stay informed, stay disciplined, and may your trading journey be prosperous.