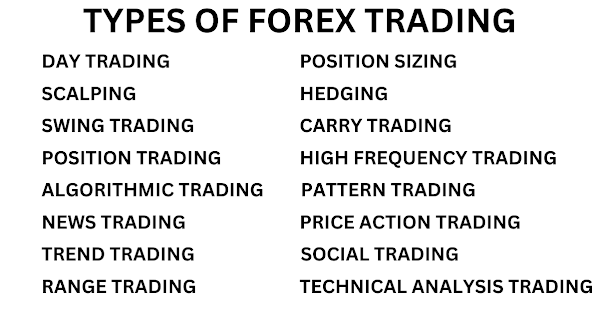

Types of Forex Trading: A Comprehensive Guide

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies with the aim of making a profit. The forex market is the largest financial market in the world, with over $6 trillion traded daily. There are many different types of forex trading strategies, each with its own benefits and drawbacks. In this article, we'll explore some of the most popular types of forex trading.

Day trading is a popular strategy that involves opening and closing positions within the same trading day. Traders who use this strategy are known as day traders. They usually look for short-term opportunities in the market and focus on small price movements. Day trading requires discipline, as traders need to monitor the market constantly and be ready to act quickly.

Scalping is a forex trading strategy that involves making multiple trades over a short period of time, usually a few seconds to a few minutes. Scalpers aim to make small profits from each trade, with the hope that these small profits will add up over time. This strategy requires a lot of skill and experience, as scalpers need to be able to quickly identify market trends and act on them.

Swing trading is a strategy that involves holding positions for several days or weeks. Swing traders aim to take advantage of longer-term trends in the market. This strategy is less demanding than day trading or scalping, as traders have more time to make decisions. However, swing trading requires patience and discipline, as traders need to wait for the right opportunities to present themselves.

Position trading is a strategy that involves holding positions for weeks, months, or even years. Position traders aim to take advantage of long-term trends in the market. This strategy is less demanding than swing trading, as traders have even more time to make decisions. However, position trading requires a lot of patience, as traders need to be able to withstand market fluctuations.

Algorithmic trading, also known as algo trading, is a strategy that uses computer algorithms to execute trades automatically. Algo traders use complex mathematical models to identify patterns in the market and make trades based on those patterns. This strategy is popular among institutional traders and hedge funds, but it can also be used by individual traders who have the technical skills to develop their own algorithms.

News trading is a strategy that involves trading based on the release of economic data or other news events. Traders who use this strategy analyze the impact of news events on the forex market and take positions accordingly. For example, if a country's central bank announces an interest rate hike, traders might buy that country's currency, as higher interest rates can lead to a stronger currency.

Trend trading is a strategy that involves trading in the direction of the overall trend in the market. Traders who use this strategy identify the current trend in the market and take positions in that direction. For example, if the market is in an uptrend, traders might look for opportunities to buy, while if the market is in a downtrend, they might look for opportunities to sell.

Range trading is a strategy that involves identifying and trading within a range-bound market. Traders who use this strategy look for opportunities to buy at the lower end of the range and sell at the upper end of the range. This strategy can be useful in markets that are not experiencing significant trends or volatility.

Position sizing is not a specific trading strategy, but rather a method for managing risk. Traders who use position sizing adjust the size of their positions based on their risk tolerance and the size of their trading account. For example, if a trader has a small trading account, they might use smaller position sizes to minimize their risk.

Hedging is a strategy that involves opening a trade to protect against potential losses in another trade. For example, if a trader has a long position on a currency pair, they might open a short position on the same currency pair to hedge against potential losses.

Carry trading is a strategy that involves borrowing money in a currency with a low interest rate and investing that money in a currency with a higher interest rate. Traders who use this strategy aim to profit from the interest rate differential between the two currencies.

High-frequency trading is a strategy that involves using algorithms to execute trades at high speeds, sometimes within microseconds. HFT is a popular strategy among institutional traders, as it allows them to take advantage of small price movements in the market.

Pattern trading is a strategy that involves identifying and trading based on patterns in the market, such as chart patterns or candlestick patterns. Traders who use this strategy look for specific patterns that indicate a potential price movement and take positions accordingly.

Price action trading is a strategy that involves analyzing price movements in the market to make trading decisions. Traders who use this strategy do not rely on indicators or other technical analysis tools, but instead focus on price movements and market psychology.

Social trading is a strategy that involves copying the trades of other traders. Traders who use this strategy can follow and copy the trades of more experienced traders, with the aim of replicating their success. Social trading platforms allow traders to connect with and follow other traders, making it easier to find successful traders to copy.

Technical analysis trading is a strategy that involves using technical indicators and chart patterns to make trading decisions. Traders who use this strategy look for patterns in market data, such as trends, support and resistance levels, and other indicators, to identify potential price movements. Technical analysis trading can be useful for traders who prefer a more systematic approach to trading, and who are comfortable using technical tools to make trading decisions.

Conclusion

In conclusion, there are many different types of forex trading strategies, each with its own approach to analyzing the market and making trading decisions. Traders should choose a strategy that matches their trading style, risk tolerance, and financial goals, and should always remember that all trading involves risk. With the right strategy and a disciplined approach to trading, however, anyone can become a successful forex trader.

No comments:

Post a Comment